Global Rigid Plastic Packaging Market, By Production Process (Extrusion, Injection Molding, Blow Molding, Thermoforming), Raw Material (Bioplastics, Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polystyrene (PS), Polyvinyl Chloride (PVC), Expanded Polystyrene (EPS)), Type (Bottles & Jars, Rigid Bulk Products, Trays, Tubs, Cups, & Pots), Application (Food, Beverages, Cosmetics & Toiletries, Healthcare, Industrial), and Region – Industry Analysis and Forecast to 2030

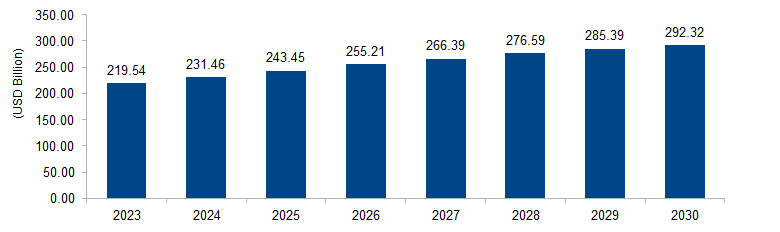

The global rigid plastic packaging market is expected to grow from USD 219.54 billion in 2023 to USD 292.32 billion by 2030 at a CAGR of 4.2%. The market is driven by its versatility, durability, and lightweight nature, making it an ideal choice for packaging across various industries. Its ability to protect products, enhance shelf life, and offer design flexibility meets the evolving needs of consumers and manufacturers, fostering its widespread adoption in the packaging sector.

Figure 1: Global Rigid Plastic Packaging Market Size, 2023-2030 (USD Billion)

Source: Secondary Research, Expert Interviews, and MAARECO Analysis

Rigid Plastic Packaging refers to containers and packaging materials made from sturdy, inflexible polymers such as polyethylene terephthalate (PET), polyethylene (PE), polypropylene (PP), and others. These materials provide structural strength, durability, and resistance to impact, ensuring the protection of products during storage, transportation, and display. Rigid plastic packaging is extensively used in various industries, including food and beverage, pharmaceuticals, cosmetics, and household products, due to its versatility, cost-effectiveness, and recyclability. It offers an array of shapes and sizes, allowing for customization, and its lightweight nature contributes to reduced transportation costs and environmental impact.

Rigid Plastic Packaging Market Drivers

Growing Demand for Sustainable Packaging Solutions

One significant driver of the rigid plastic packaging market is the increasing demand for sustainable packaging solutions across industries. As global awareness of environmental issues rises, there is a growing emphasis on adopting eco-friendly packaging materials. Rigid plastic packaging, particularly when made from recyclable materials like PET or HDPE, aligns with this sustainability trend. According to the American Chemistry Council, the recycling rate of rigid plastics in the U.S. reached 35.7% in 2018. Governments and industry associations worldwide are encouraging the use of recycled content in packaging to reduce environmental impact.

The demand for sustainable packaging is evident in various sectors, such as the beverage industry, where manufacturers are increasingly opting for PET bottles made from recycled materials. The Circular Economy Action Plan in Europe, aiming for a more circular and sustainable economy, further reinforces the importance of recycled content in plastic packaging. As consumer preferences shift towards environmentally responsible choices, the rigid plastic packaging market is driven by the need to provide sustainable solutions that meet regulatory standards and cater to a conscientious consumer base.

Advancements in Packaging Technologies and Innovations

Advancements in packaging technologies represent another key driver for the rigid plastic packaging market. Ongoing innovations in materials, design, and manufacturing processes contribute to the development of high-performance and technologically advanced rigid plastic packaging solutions. For instance, the incorporation of barrier coatings, antimicrobial additives, and smart packaging features enhances the functionality and shelf life of packaged products.

The use of advanced molding techniques, such as injection molding and blow molding, allows for intricate designs and shapes, providing manufacturers with increased flexibility in packaging customization. Innovations in barrier technologies, as seen in multilayered plastic structures, help preserve the freshness of food and extend the shelf life of products. According to the Society of Plastics Engineers, advancements in polymer science and processing technologies contribute to the continuous improvement of rigid plastic packaging properties.

As manufacturers seek to address evolving consumer needs and enhance the performance of their packaging solutions, the rigid plastic packaging market benefits from ongoing technological innovations that drive efficiency, functionality, and product differentiation. These advancements position rigid plastic packaging as a dynamic and responsive segment within the broader packaging industry.

Rigid Plastic Packaging Market Restraints

Environmental Concerns and Single-Use Plastics Criticism

A notable restraint for the rigid plastic packaging market is the increasing scrutiny and criticism of single-use plastics, leading to heightened environmental concerns. Governments, environmental organizations, and consumers globally are advocating for reduced plastic usage to mitigate pollution and plastic waste. According to the United Nations Environment Programme (UNEP), only 9% of all plastic waste generated has been recycled, and the majority ends up in landfills or oceans, causing severe environmental issues.

Rigid plastic packaging, often associated with single-use items like bottles and containers, faces backlash due to its perceived contribution to plastic pollution. Governments are implementing stringent regulations to curb single-use plastics, such as bans on certain plastic products or the introduction of extended producer responsibility (EPR) programs. The European Union’s Single-Use Plastics Directive, for example, targets specific plastic products, aiming to reduce their consumption. This regulatory landscape poses a significant challenge for the rigid plastic packaging market, necessitating a shift towards more sustainable alternatives and circular economy practices to address environmental concerns and align with evolving regulations.

Limited Biodegradability and Microplastic Concerns

Another restraint for the rigid plastic packaging market is the limited biodegradability of certain plastic types and the associated concerns about microplastic pollution. While rigid plastics are durable and offer excellent product protection, their slow degradation process raises environmental challenges. The degradation of plastics into microplastic particles, often due to exposure to sunlight and weathering, has become a focal point of environmental discussions. According to research published in Environmental Science & Technology, microplastics are pervasive in various environments and can have adverse ecological impacts.

Rigid plastic packaging materials, especially those composed of traditional polymers like polyethylene and polypropylene, may persist in the environment for extended periods. This persistence raises concerns about their potential contribution to the microplastic pollution problem. As awareness of microplastic pollution grows, there is increasing pressure on industries to find solutions that balance the benefits of rigid plastic packaging with environmental considerations. The rigid plastic packaging market faces challenges in addressing these concerns, prompting a shift towards biodegradable or compostable alternatives and encouraging innovations that minimize the environmental impact of plastic packaging.

Rigid Plastic Packaging Market Opportunities

E-commerce Packaging Growth

An opportune avenue for the rigid plastic packaging market lies in the rapid expansion of e-commerce. The surge in online shopping, driven by changing consumer preferences and the convenience of digital platforms, presents a significant opportunity for rigid plastic packaging. According to the United Nations Conference on Trade and Development (UNCTAD), global e-commerce sales reached $26.7 trillion in 2019, with projections indicating continued growth.

Rigid plastic packaging, with its robust and protective properties, is well-suited for the demands of e-commerce logistics. The need for secure and damage-resistant packaging solutions is paramount in the e-commerce supply chain, where products undergo various handling and transportation stages. Rigid plastic materials like PET and HDPE provide durability and protection against impacts, ensuring that products reach consumers in optimal condition. As the e-commerce market expands, the rigid plastic packaging market can capitalize on this opportunity by offering innovative, sustainable, and efficient packaging solutions tailored to the unique requirements of online retail.

Focus on Lightweighting and Source Reduction

An opportunity for the rigid plastic packaging market lies in the focus on lightweighting and source reduction initiatives. Governments and industry associations globally are emphasizing the need to reduce packaging waste by optimizing material usage and minimizing environmental impact. Lightweighting involves designing packaging with thinner walls or using innovative materials to maintain strength while reducing overall weight. This approach aligns with circular economy principles and supports sustainability goals.

Rigid plastic packaging manufacturers can capitalize on this opportunity by investing in research and development to create lighter yet equally effective packaging solutions. The Plastics Industry Association highlights the importance of lightweighting to reduce the environmental footprint of plastic packaging. This approach not only contributes to environmental sustainability but also addresses consumer preferences for eco-friendly products. The market can explore technologies such as advanced molding techniques and material innovations to achieve source reduction goals while maintaining the integrity and functionality of rigid plastic packaging. Embracing lightweighting initiatives positions the rigid plastic packaging market as a proactive participant in the broader movement towards sustainable and responsible packaging practices.

Rigid Plastic Packaging Market Challenges

End-of-life Management Challenges

A significant challenge for the rigid plastic packaging market is the complex landscape of end-of-life management for plastic waste. While rigid plastic packaging offers benefits in terms of durability and protection, the disposal and recycling of such materials pose challenges. According to the Ellen MacArthur Foundation, only 16% of plastic packaging is recycled globally, highlighting the existing gap in efficient end-of-life management. Rigid plastics, including those used in packaging, face issues related to collection, sorting, and recycling infrastructure.

One specific challenge is the need for improved recycling technologies to handle diverse types of rigid plastics. The existence of different resin types and complex packaging structures makes recycling more intricate. Additionally, contamination in the recycling stream hampers the quality of recycled materials. The implementation of extended producer responsibility (EPR) programs and investments in recycling infrastructure are essential to overcoming these challenges. The rigid plastic packaging market must collaborate with stakeholders across the value chain to enhance recycling capabilities, ensuring a more circular approach to plastic packaging and reducing the environmental impact of plastic waste.

Shift towards Alternative Materials

A notable challenge facing the rigid plastic packaging market is the increasing trend towards exploring and adopting alternative packaging materials. As sustainability concerns intensify, there is a growing interest in materials perceived as more environmentally friendly than traditional plastics. According to the World Economic Forum, alternative materials like bioplastics and plant-based materials are gaining attention as potential substitutes for conventional plastics.

This shift poses a challenge for the rigid plastic packaging market as it necessitates adaptation to changing consumer preferences and regulatory landscapes. Bioplastics, for instance, are derived from renewable resources and are considered biodegradable or compostable in certain conditions. While rigid plastic packaging offers robustness and efficiency, the market faces the challenge of navigating the evolving landscape of sustainable packaging materials. Manufacturers need to explore innovations, such as incorporating recycled content or adopting bio-based alternatives, to remain competitive and align with the global move towards more sustainable and environmentally responsible packaging solutions. The challenge lies in striking a balance between the established advantages of rigid plastic packaging and the evolving demands for eco-friendly alternatives.

Regional Trends

North America: In North America, there has been a notable trend towards sustainable packaging solutions. The rigid plastic packaging market has witnessed an increased focus on recyclability, use of recycled content, and innovations in eco-friendly packaging materials. Regulatory initiatives in some states and cities, such as plastic bans and extended producer responsibility (EPR) programs, have influenced market dynamics. Moreover, the demand for lightweight and convenient packaging solutions has driven innovations in the design and functionality of rigid plastic packaging.

Europe: Europe has been at the forefront of sustainability efforts, influencing trends in the rigid plastic packaging market. The circular economy principles and ambitious recycling targets set by the European Union have directed the market towards more sustainable practices. The emphasis on reducing single-use plastics and promoting a circular approach to packaging has led to increased adoption of recyclable and reusable rigid plastic packaging. Collaboration between industry stakeholders and policymakers to address environmental concerns has shaped trends in this region.

Asia Pacific: In the Asia Pacific region, the rigid plastic packaging market has seen growth in tandem with the expanding consumer goods and food and beverage industries. Increased urbanization, rising disposable incomes, and changing lifestyles have driven the demand for rigid plastic packaging. Additionally, there has been a push towards incorporating advanced technologies in packaging, such as smart packaging features and innovative designs. The region’s packaging market has also been influenced by the global shift towards sustainable practices, leading to efforts to adopt eco-friendly materials.

Middle East and Africa: In the Middle East and Africa, the rigid plastic packaging market trends have been influenced by economic development, population growth, and changing consumer preferences. The demand for packaged goods, particularly in the food and beverage sector, has driven the market. While sustainability considerations are gaining traction, the market dynamics are also shaped by factors such as urbanization, infrastructure development, and the need for cost-effective packaging solutions.

Latin America: Latin America has seen trends in the rigid plastic packaging market that align with the region’s economic growth and expanding industries. The market has responded to the demand for efficient and visually appealing packaging solutions. Sustainable packaging practices are gaining attention, with an increasing focus on reducing environmental impact. The region’s packaging market dynamics are influenced by a balance between economic factors, consumer preferences, and sustainability goals.

Key Players

Key players operating in the global polyvinyl alcohol films market are Amcor, Pactiv Evergreen, Berry Global Group Inc., Silgan Holdings Inc., Sonoco Products Company, DS Smith PLC, Alpla, SABIC, Takween Advanced Industries, Al Jabri Plastic Factory, Nuplas Industries Ltd, Altium Packaging Lp, Plastipak Holdings, Inc., Hitech Corporation, Lacerta Group Inc., Winpak Ltd, US Pack Group, and Klöckner Pentaplast.

PRICE

ASK FOR FREE SAMPLE REPORT