Global Process Analyzer Market, By Liquid Analyzer (pH/ORP Analyzer, Conductivity Analyzer, Dissolved Oxygen Analyzer, Turbidity Analyzer, Liquid Density Analyzer, TOC Analyzer, MLSS Analyzer), Gas Analyzer (Oxygen Analyzer, Carbon Dioxide Analyzer, Toxic Gas Analyzer, Moisture Analyzer, Hydrogen Sulfide Analyzer), Industry (Oil & Gas, Petrochemical, Pharmaceutical, Food & Beverage, Water & Wastewater, Metals & Mining, Power, Paper & Pulp, Cement & Glass), and Region — Industry Analysis and Forecast to 2030

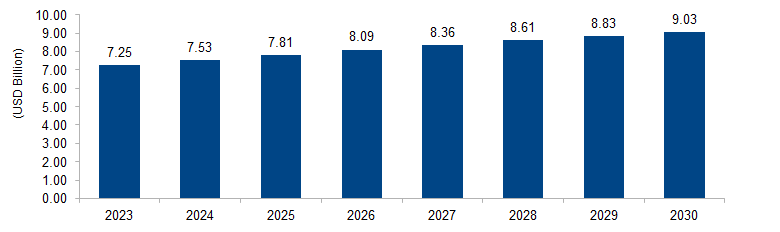

The global process analyzer market is expected to grow from USD 7.25 billion in 2023 to USD 9.03 billion by 2030 at a CAGR of 3.2%. The market is driven by the increasing demand for accurate and real-time monitoring of industrial processes. Industries, such as petrochemicals, pharmaceuticals, and water treatment, utilize process analyzers to ensure product quality, optimize production efficiency, and comply with regulatory standards. The need for precision and efficiency in process control fuels market growth.

Figure 1: Global Process Analyzer Market Size, 2023-2030 (USD Billion)

Source: Secondary Research, Expert Interviews, and MAARECO Analysis

A process analyzer refers to an instrument or system employed in industrial settings to continuously monitor and analyze various parameters within a production process. It plays a critical role in sectors such as petrochemicals, pharmaceuticals, and environmental monitoring. Process analyzers measure variables like chemical composition, concentration, and physical properties, providing real-time data for quality control, process optimization, and regulatory compliance. These analyzers utilize diverse techniques such as spectroscopy, chromatography, and sensors to ensure accuracy. By facilitating continuous monitoring, process analyzers contribute to enhanced efficiency, reduced operational risks, and improved product quality in industrial operations.

Process Analyzer Market Drivers

Stringent Regulatory Standards in Industries

One prominent driver for the process analyzer market is the imposition of stringent regulatory standards across industries, particularly in sectors like petrochemicals, pharmaceuticals, and environmental monitoring. Regulatory bodies, such as the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA), set stringent guidelines to ensure product quality, safety, and environmental compliance. For instance, in the water treatment sector, the EPA mandates continuous monitoring of water quality parameters. The demand for adherence to these standards propels the adoption of advanced process analyzers. As per EPA’s guidelines, industries are required to monitor and control pollutants continuously. This creates a significant market opportunity for process analyzers, which play a crucial role in meeting and exceeding these regulatory requirements. The increasing complexity of regulatory frameworks globally amplifies the need for sophisticated process analyzers, driving their integration into industrial processes.

Growing Emphasis on Industry 4.0 and Smart Manufacturing

Another driving force for the process analyzer market is the growing emphasis on Industry 4.0 and the broader trend of smart manufacturing. Industry 4.0 initiatives aim to digitize and automate industrial processes for enhanced efficiency and data-driven decision-making. Process analyzers play a pivotal role in this digital transformation by providing real-time insights into various parameters critical for manufacturing processes. For example, in petrochemical refineries, the integration of process analyzers supports predictive maintenance and ensures optimal resource utilization. The market benefits from the increased adoption of smart manufacturing technologies that leverage IoT-enabled devices and analytics. The emphasis on connectivity, automation, and data exchange in smart manufacturing creates a favorable landscape for the growth of the process analyzer market. As industries strive for intelligent and connected operations, the demand for advanced process analyzers is propelled by their role in achieving the goals of Industry 4.0.

Process Analyzer Market Restraints

High Initial Investment Costs and Operational Expenses

A significant restraint for the process analyzer market is the high initial investment costs associated with the procurement and installation of advanced process analyzers. The capital expenditure required for implementing sophisticated analyzer systems, such as those employing cutting-edge technologies like mass spectrometry or high-performance chromatography, can be substantial. According to the American Chemistry Council, capital costs are a critical factor affecting investment decisions in the chemical manufacturing industry. Industries, especially in sectors like petrochemicals and pharmaceuticals, may face challenges in allocating budgets for the upfront costs of these analyzers. Additionally, ongoing operational expenses, including maintenance, calibration, and personnel training, contribute to the total cost of ownership. High operational costs can deter some industries, particularly smaller enterprises, from embracing advanced process analyzer technologies. Overcoming this restraint requires innovative business models, such as leasing options or collaborative partnerships, to make these technologies more accessible to a broader range of industrial players.

Complexity in Analyzer Integration and System Compatibility

Another notable restraint for the process analyzer market is the complexity associated with integrating analyzers into existing industrial processes and ensuring compatibility with diverse system architectures. According to the International Society of Automation (ISA), industries often operate with legacy systems and diverse communication protocols, making seamless integration a challenging task. The mismatch in system architectures can lead to difficulties in data interoperability and compromise the overall effectiveness of process analyzers. Additionally, industries may face challenges in standardizing communication interfaces, especially in sectors with diverse equipment and instrumentation. The complexity of integration can result in prolonged implementation times, increased costs, and potential disruptions to ongoing operations. Addressing this restraint requires the development of standardized communication protocols, flexible and modular analyzer solutions, and collaboration between industry stakeholders to establish interoperability standards. Simplifying the integration process enhances the adoption of process analyzers across industries, ensuring a smoother transition to advanced monitoring technologies.

Process Analyzer Market Opportunities

Integration of Artificial Intelligence and Machine Learning

An exciting opportunity for the process analyzer market lies in the integration of artificial intelligence (AI) and machine learning (ML) technologies. The increasing complexity of industrial processes generates vast amounts of data from process analyzers. Leveraging AI and ML algorithms enables advanced analytics, pattern recognition, and predictive modeling. For example, in the chemical manufacturing sector, AI-driven analyzers can predict equipment failures, optimize production schedules, and enhance overall process efficiency. According to the World Economic Forum, AI in manufacturing is expected to result in a significant increase in productivity. The opportunity involves developing process analyzers with embedded AI capabilities, fostering partnerships between analyzer manufacturers and AI solution providers, and creating analytics platforms that can harness the potential of data generated by analyzers. This trend aligns with the broader Industry 4.0 paradigm, offering substantial growth prospects for the process analyzer market as industries seek intelligent and autonomous analytical solutions.

Expansion in Emerging Markets and Niche Applications

An emerging opportunity for the process analyzer market is the expansion into emerging markets and niche applications. As industries in developing regions, such as Southeast Asia, South America, and Africa, undergo rapid industrialization, there is a growing demand for advanced process analyzers to ensure operational efficiency and compliance with environmental regulations. According to the United Nations Industrial Development Organization (UNIDO), these regions are witnessing significant growth in industrial output. The opportunity involves tailoring process analyzer solutions to the specific needs and challenges of these emerging markets. Additionally, niche applications in specialized industries, such as biotechnology, food and beverages, and renewable energy, present untapped market potential. For instance, analyzers for monitoring fermentation processes in biotechnology or ensuring quality control in food production. Focusing on these niche applications requires innovative product development and market strategies, expanding the reach of process analyzers beyond traditional sectors and contributing to the diversification and globalization of the market.

Process Analyzer Market Challenges

Data Security and Privacy Concerns

A significant challenge for the process analyzer market is the increasing concern over data security and privacy in industrial settings. With the growing adoption of digital technologies and connectivity in process analyzers, there is a heightened risk of cybersecurity threats. Unauthorized access to sensitive data from analyzers can result in operational disruptions, intellectual property theft, and compromise of proprietary processes. According to the International Society of Automation (ISA), industries are facing challenges in implementing robust cybersecurity measures, and there is a need for standardized frameworks to secure industrial control systems. The challenge involves developing analyzer solutions with built-in cybersecurity features, ensuring data encryption, and establishing industry-wide standards for secure communication. Addressing these concerns is crucial for gaining the trust of industries, especially in sectors dealing with highly confidential processes, and fostering wider acceptance of advanced process analyzers in the market.

Customization Complexity and Industry-Specific Requirements

Another notable challenge for the process analyzer market is the complexity associated with customizing analyzer solutions to meet industry-specific requirements. Different industrial sectors often have unique processes, operating conditions, and regulatory standards. According to the European Chemical Industry Council (Cefic), the chemical manufacturing industry, for instance, requires highly specialized analyzers to monitor complex reactions and ensure product quality. The challenge involves developing versatile process analyzers that can be easily customized to suit diverse industry needs. Additionally, the demand for analyzers with niche functionalities, such as those tailored for specific chemicals or applications, adds to the complexity. Striking a balance between standardization and customization is essential. Overcoming this challenge requires close collaboration between analyzer manufacturers and industry stakeholders, involving end-users in the product development process, and offering flexible solutions that can adapt to the unique requirements of different industrial settings.

Regional Trends

North America: In North America, the process analyzer market has been witnessing a trend toward the integration of advanced technologies, including process analyzers, in industries such as petrochemicals, pharmaceuticals, and energy. Government initiatives to enhance industrial efficiency and compliance with environmental regulations, such as those by the Environmental Protection Agency (EPA) in the United States, contribute to the adoption of sophisticated analyzer systems. The trend also includes the incorporation of Industry 4.0 technologies, where process analyzers play a crucial role in providing real-time data for smart manufacturing applications.

Europe: Europe has seen a trend of increasing emphasis on sustainability and environmental compliance, driving the adoption of process analyzers in industries. The European Union’s directives on environmental protection and resource efficiency have led to a growing demand for analyzers that can monitor and control emissions, waste, and energy consumption. The trend involves the integration of process analyzers with digital technologies to achieve more sustainable and eco-friendly manufacturing practices.

Asia Pacific: The Asia Pacific region has been experiencing a trend of rapid industrialization, particularly in countries like China and India, leading to increased demand for process analyzers. As these economies focus on improving manufacturing capabilities, analyzers play a vital role in ensuring product quality, safety, and compliance. Additionally, the adoption of advanced technologies in sectors like chemicals, electronics, and pharmaceuticals contributes to the growth of the process analyzer market in the region.

Middle East and Africa: In the Middle East and Africa, the process analyzer market trend is influenced by the region’s dominance in the oil and gas industry. Process analyzers are widely used in refineries and petrochemical plants for monitoring and controlling various parameters. With a focus on operational efficiency and adherence to international standards, industries in this region continue to invest in advanced analyzer technologies.

Latin America: Latin America has been witnessing a trend of increasing investments in industries such as mining, energy, and chemicals, driving the adoption of process analyzers. Governments in the region are promoting industrial growth, and the need for accurate monitoring of processes aligns with the utilization of advanced analyzer systems. The trend also involves addressing environmental concerns through the implementation of analyzers for pollution control and compliance.

Key Players

Key players operating in the global process analyzer market are ABB, Siemens, Emerson Electric Co., Endress+Hauser Group Services AG, Yokogawa Electric Corporation, Mettler Toledo, SUEZ, Thermo Fisher Scientific Inc., Ametek, Inc., Anton Paar GmbH, Hach, Shimadzu Corporation, JUMO GmbH & Co. KG, Applied Analytics, Inc., Omega Engineering, Inc., Vega Grieshaber Kg, Schmidt + Haensch, and Sartorius AG.

PRICE

ASK FOR FREE SAMPLE REPORT