Global Flexible Plastic Packaging Packaging Market, By Application (Food, Beverages, Pharmaceuticals & Healthcare, Personal Care & Cosmetics), Material (Plastics, Aluminum Foils), Packaging Type (Pouches, Rollstock, Bags, Films & Wraps), Printing Technology (Flexography, Rotogravure, Digital Printing), and Region – Industry Analysis and Forecast to 2030

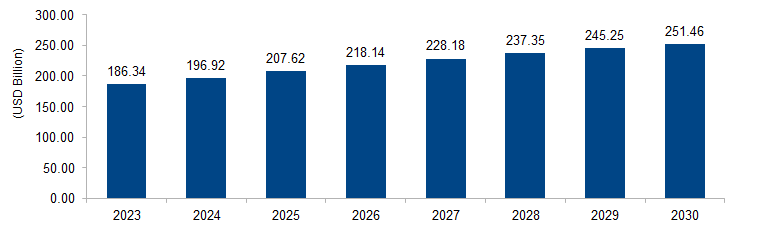

The global flexible plastic packaging market is expected to grow from USD 186.34 billion in 2023 to USD 251.46 billion by 2030 at a CAGR of 4.4%. The market is propelled by its lightweight and cost-effective nature, offering versatile solutions for diverse industries. With a focus on sustainability, manufacturers are innovating to develop recyclable and eco-friendly flexible plastic materials. Additionally, the growing demand for convenience packaging in sectors like food and e-commerce fuels market expansion, enhancing product preservation and consumer convenience.

Figure 1: Global Flexible Plastic Packaging Market Size, 2023-2030 (USD Billion)

Source: Secondary Research, Expert Interviews, and MAARECO Analysis

Flexible Plastic Packaging refers to a dynamic and adaptable form of packaging made from plastic materials that can easily conform to various shapes, sizes, and product contours. This packaging type includes bags, pouches, films, and wraps, offering versatility across industries. Flexible plastic packaging is known for its lightweight nature, cost-effectiveness, and ability to extend shelf life. It is widely used in food, beverage, pharmaceuticals, and consumer goods sectors, providing a convenient and efficient solution for packaging products. The continuous innovation in materials and technologies within this category aims to enhance sustainability by focusing on recyclability and eco-friendly alternatives.

Flexible Plastic Packaging Market Drivers

Lightweight Nature and Cost-Effectiveness

One of the significant drivers propelling the flexible plastic packaging market is the packaging’s lightweight nature and cost-effectiveness. Flexible plastic materials, such as polyethylene and polypropylene, are inherently lightweight, contributing to reduced transportation costs and energy consumption throughout the supply chain. The lighter weight not only enhances logistical efficiency but also aligns with sustainability goals by minimizing carbon emissions associated with transportation. According to the Flexible Packaging Association (FPA), lightweighting and downgauging practices in the industry have led to source reduction, decreasing the amount of material required for packaging production.

Moreover, the cost-effectiveness of flexible plastic packaging is a key driver for its widespread adoption. The production and conversion processes of flexible plastic materials are often more economical compared to rigid packaging alternatives. This cost efficiency is particularly beneficial for industries with high-volume production and large-scale distribution, such as the food and beverage sector. The Flexible Packaging Association notes that cost advantages, coupled with the ability to accommodate a variety of products, contribute to the continuous growth of the flexible plastic packaging market.

Versatility and Innovation for Sustainable Solutions

Versatility and a commitment to sustainability are driving forces in the flexible plastic packaging market. The adaptability of flexible plastic materials allows for a diverse range of packaging formats, including pouches, bags, and films, suitable for various industries. This versatility caters to evolving consumer demands for convenience and practicality in packaging solutions. According to the Sustainable Packaging Coalition, innovations in flexible plastic packaging include the development of recyclable materials, advanced barrier coatings, and compatibility with emerging recycling technologies.

The market is witnessing a shift towards sustainable practices as manufacturers increasingly invest in research and development to create eco-friendly alternatives. For instance, the development of biodegradable and compostable flexible plastic materials addresses concerns about environmental impact. Industry associations, like The Association of Plastic Recyclers (APR), work towards advancing recycling technologies for flexible plastic packaging. The commitment to sustainability not only meets consumer expectations but also aligns with global initiatives promoting a circular economy, driving the market towards more environmentally responsible practices.

Flexible Plastic Packaging Market Restraints

Environmental Concerns and Single-Use Plastics

A significant restraint for the flexible plastic packaging market is the rising environmental concerns associated with single-use plastics. The proliferation of plastic waste, particularly single-use packaging, has led to growing ecological challenges and calls for sustainable alternatives. The negative environmental impact of flexible plastic packaging is underscored by statistics from organizations like the Ellen MacArthur Foundation, which estimates that by 2050, there could be more plastics than fish in the ocean if current consumption and disposal patterns persist. This has prompted regulatory bodies and governments globally to enact measures addressing single-use plastics.

For instance, the European Union’s Single-Use Plastics Directive targets the reduction of certain plastic products, including packaging. The limitations imposed on the use of single-use plastics pose challenges for the flexible plastic packaging market, requiring manufacturers to explore alternative materials and develop circular economy practices. The need for extended producer responsibility (EPR) and recycling infrastructure improvements further accentuates the environmental restraints associated with single-use flexible plastic packaging.

Recycling Challenges and Limited Infrastructure

Another significant restraint for the flexible plastic packaging market is the intricate challenge of recycling and the limited infrastructure for certain types of flexible plastics. While many flexible plastic materials are technically recyclable, the reality is that the recycling rates remain relatively low. The Flexible Packaging Association notes that only a small percentage of flexible plastic packaging is recycled, primarily due to the complexity of the materials involved and the lack of efficient recycling systems for multi-layered structures.

The absence of widespread collection and processing systems for certain flexible plastic materials poses a significant challenge. According to the U.S. Environmental Protection Agency (EPA), in 2018, only 9.1% of plastic packaging was recycled. Achieving higher recycling rates requires investments in advanced recycling technologies and improved collection infrastructure, which can be both economically and logistically challenging. Overcoming these recycling challenges is crucial for the flexible plastic packaging market to align with evolving sustainability goals and address concerns related to plastic pollution.

Flexible Plastic Packaging Market Opportunities

Smart Packaging Integration

An exciting opportunity for the flexible plastic packaging market lies in the integration of smart packaging technologies. The industry can leverage innovations such as Radio-Frequency Identification (RFID), Near Field Communication (NFC), and QR codes to enhance product traceability, consumer engagement, and supply chain visibility. Smart packaging enables real-time monitoring of product conditions, ensuring freshness and quality. According to the study, the global smart packaging market is anticipated to reach $7.8 billion by 2025. Flexible plastic packaging can play a pivotal role in this growth by seamlessly incorporating these technologies into its design, opening avenues for improved customer experiences and efficient supply chain management. The adoption of smart packaging solutions presents an innovative opportunity for the industry to differentiate its offerings and stay ahead in the competitive landscape, catering to the demands of a technologically driven market.

E-commerce Packaging Expansion

The growth of e-commerce presents a significant opportunity for the flexible plastic packaging market. With the increasing trend of online shopping, there is a surge in demand for packaging solutions tailored to the unique challenges of e-commerce logistics. Flexible plastic materials, such as polyethylene and polypropylene, are well-suited for packaging items sold through online platforms. The convenience, durability, and adaptability of flexible plastic packaging make it an ideal choice for protecting goods during transit. According to the study, global e-commerce sales are projected to surpass $6.38 trillion in 2024. This escalating e-commerce market creates a substantial opportunity for flexible plastic packaging providers to meet the specific requirements of online retail, including the need for lightweight, space-efficient, and visually appealing packaging solutions. The industry can capitalize on this opportunity by tailoring products to address the evolving demands of the booming e-commerce sector, thus fueling its growth.

Flexible Plastic Packaging Market Challenges

Consumer Perception and Plastic Waste

A significant challenge for the flexible plastic packaging market is the evolving consumer perception regarding plastic waste and its environmental impact. Increasing environmental awareness has led consumers to scrutinize packaging choices, favoring materials perceived as more sustainable. While flexible plastic packaging offers numerous advantages, including lightweight and cost-effectiveness, it faces the challenge of negative public perception associated with plastic pollution. Governments and organizations globally are taking steps to reduce single-use plastics, impacting consumer preferences. For instance, bans on single-use plastic bags are becoming more prevalent. This shift in consumer sentiment poses a challenge for the flexible plastic packaging industry to address concerns about plastic waste, emphasizing the need for sustainable practices and materials. The challenge involves not only meeting regulatory expectations but also educating consumers about the advancements in recyclability and circular economy initiatives within the flexible plastic packaging sector.

Supply Chain Disruptions and Raw Material Availability

A notable challenge for the flexible plastic packaging market is the susceptibility to supply chain disruptions and fluctuations in raw material availability. The industry relies on a complex global network of suppliers for various materials, including polymers and additives. Recent events, such as the COVID-19 pandemic, underscored the vulnerability of global supply chains. Disruptions in the availability of raw materials, influenced by factors like geopolitical tensions and economic uncertainties, can impact production costs and lead to market volatility. The World Trade Organization notes that disruptions in global trade can affect the availability of inputs for various industries. Flexible plastic packaging manufacturers face the challenge of securing a stable and resilient supply chain to navigate uncertainties, ensuring consistent access to essential raw materials. Strategic planning, diversification of suppliers, and proactive measures to address supply chain risks become imperative for the industry to overcome these challenges and maintain a robust market presence.

Regional Trends

North America: North America has been witnessing a growing trend towards sustainable flexible plastic packaging solutions. Regulatory initiatives and consumer awareness have driven a shift towards recyclable and eco-friendly materials. The adoption of advanced recycling technologies and the development of bio-based plastics have been notable trends. Additionally, there has been an emphasis on reducing single-use plastics, with various states implementing bans on certain plastic products.

Europe: In Europe, the flexible plastic packaging market has been influenced by the Circular Economy Package and the European Green Deal. The region has seen an increased focus on enhancing the recyclability of flexible plastic packaging and reducing plastic waste. Extended Producer Responsibility (EPR) schemes and initiatives promoting a circular economy have shaped industry trends. The development of compostable and bio-based plastics has gained traction to align with the EU’s goal of reducing plastic pollution.

Asia Pacific: The Asia Pacific region has experienced dynamic growth in the flexible plastic packaging market, driven by rapid industrialization and urbanization. The demand for convenience packaging, especially in the food and beverage sector, has been a prevailing trend. The adoption of stand-up pouches and flexible films has increased, catering to the diverse consumer preferences in the region. Additionally, advancements in smart packaging technologies have been observed, enhancing supply chain efficiency.

Middle East and Africa: In the Middle East and Africa, the flexible plastic packaging market trends have been influenced by economic development and changing consumer lifestyles. The demand for packaged food and beverages has driven the adoption of flexible packaging solutions. The industry has been adapting to the unique preferences and challenges of the Middle East and Africa markets, with a focus on cost-effective and visually appealing packaging options.

Latin America: Latin America has seen a trend towards the adoption of flexible plastic packaging in response to economic growth and changing consumer habits. The region’s flexible packaging market has been characterized by innovations in packaging design and materials. The development of sustainable and recyclable flexible packaging solutions has gained attention, aligning with the global push for environmentally responsible practices.

Key Players

Key players operating in the global flexible plastic packaging market are Amcor plc, Berry Global Group, Inc., Constantia Flexibles, Huhtamaki Oyj, Sonoco Products Company, Mondi Group, Transcontinental Inc., CCL Industries Inc., Sealed Air Corporation, Coveris Holdings Sa, Bischof + Klein, Uflex Limited, Proampac, Aluflexpack AG, Novolex-Carlyle Group, Printpack, Inc., PPC Flexible Packaging LLC, and Wihuri Group.

PRICE

ASK FOR FREE SAMPLE REPORT