Global Automotive Brake System Market, By Component (Master Cylinders, Brake Pads, Brake Shoes, Brake Calipers, Brake Disc Rotors), Brake Type (Disc Brakes, Drum Brakes), Technology (Anti-Lock Braking System (ABS), Electronic Stability Control (ESC), Traction Control System (TCS), Electronic Brakeforce Distribution (EBD), Automatic Emergency Braking (AEB)), Actuation Type (Hydraulic, Pneumatic), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Trucks, Buses), and Region — Industry Analysis and Forecast to 2030

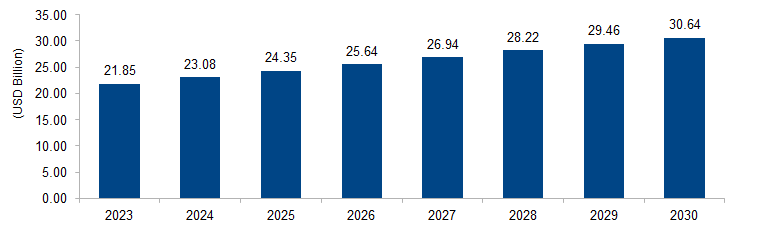

The global automotive brake system market is expected to grow from USD 21.85 billion in 2023 to USD 30.64 billion by 2030 at a CAGR of 4.9%. The market is propelled by a combination of factors, including stringent safety regulations, increasing vehicle production, and the demand for advanced braking technologies. Growing awareness of road safety, coupled with a rising focus on vehicle performance, encourages continuous innovation in brake systems. This dynamic landscape drives the expansion of the global automotive brake system market.

Figure 1: Global Brake System Market Size, 2023-2030 (USD Billion)

Source: Secondary Research, Expert Interviews, and MAARECO Analysis

An automotive brake system refers to a complex mechanism designed to slow down or stop a vehicle’s motion. It typically comprises various components, including brake pedals, brake boosters, brake fluid, brake calipers, and brake pads or shoes. When a driver applies the brakes, hydraulic or mechanical force is transmitted to the brake components, generating friction that decelerates the vehicle. Modern brake systems often incorporate advanced technologies, such as anti-lock braking systems (ABS) and electronic stability control (ESC), enhancing safety and control. Efficient brake systems are crucial for ensuring vehicle safety, maneuverability, and compliance with road regulations.

Brake System Market Drivers

Stringent Safety Regulations

One of the primary drivers of the automotive brake system market is the imposition of stringent safety regulations globally. Governments and regulatory bodies worldwide are actively implementing and updating safety standards for vehicles to enhance road safety. For instance, the National Highway Traffic Safety Administration (NHTSA) in the United States continually reviews and revises safety standards, emphasizing the importance of effective braking systems. Compliance with these regulations compels automakers to adopt advanced brake technologies, contributing to the growth of the automotive brake system market. The European Commission, through its Euro NCAP safety program, also advocates for advanced safety features, influencing the adoption of innovative brake systems across the European automotive industry.

Increasing Vehicle Production and Demand for Advanced Technologies

The surge in global vehicle production and the growing demand for advanced automotive technologies serve as significant drivers for the automotive brake system market. As the automotive industry expands, with emerging markets contributing substantially, the need for efficient and reliable braking systems intensifies. Government initiatives, such as “Automotive Mission Plan 2026” in India, which aims to make the country a global leader in automotive manufacturing, stimulate increased vehicle production. Moreover, consumers’ rising expectations for enhanced vehicle performance, safety, and comfort drive automakers to incorporate advanced brake technologies like electronic braking systems (EBS) and regenerative braking systems (RBS). This trend is particularly notable in regions experiencing robust automotive market growth, fostering a higher demand for innovative brake systems.

Brake System Market Restraints

Economic Downturn and Cost Pressures

A significant restraint in the automotive brake system market is the impact of economic downturns on the automotive industry. During periods of economic instability, there is a decline in vehicle sales, leading to reduced production volumes. The Organization for Economic Co-operation and Development (OECD) notes that economic downturns can result in a significant contraction of the automotive sector, affecting brake system manufacturers. Additionally, cost pressures within the automotive industry compel manufacturers to seek cost-effective solutions, potentially limiting investments in research and development for advanced brake technologies. The need to balance cost-effectiveness with compliance to safety standards poses a challenge, affecting the growth and innovation in the automotive brake system market.

Rapid Technological Changes and Integration Challenges

The rapid pace of technological changes in the automotive industry presents a challenge for the automotive brake system market. Continuous advancements in vehicle electrification, autonomous driving, and connectivity require brake systems to evolve and integrate seamlessly with these innovations. However, adapting traditional brake systems to meet the demands of new technologies can be complex and costly. The International Organization of Motor Vehicle Manufacturers (OICA) highlights the integration challenges faced by the automotive industry. As vehicles become more sophisticated and interconnected, brake system manufacturers need to keep pace with evolving technologies, leading to increased development costs and potential implementation challenges. This dynamic landscape poses a restraint on the automotive brake system market, requiring agility and adaptability to meet the industry’s evolving technological demands.

Brake System Market Opportunities

Electric and Hybrid Vehicle Adoption

An opportunity for the automotive brake system market lies in the increasing adoption of electric and hybrid vehicles. The transition to electric mobility has spurred innovations in braking technologies, notably regenerative braking systems. According to the International Energy Agency (IEA), the global electric car stock surpassed 10 million in 2020. The unique braking requirements of electric vehicles, with their reliance on regenerative braking to capture and store energy during deceleration, create a demand for specialized brake systems. Brake system manufacturers have the opportunity to develop and supply regenerative braking solutions that align with the evolving needs of the electric and hybrid vehicle market, contributing to the sustainability goals of the automotive industry.

Autonomous Vehicle Development

The advancement of autonomous vehicle technology presents a significant opportunity for the automotive brake system market. The proliferation of autonomous driving features requires sophisticated and reliable brake systems to ensure the safety and control of these vehicles. The Society of Automotive Engineers (SAE) defines levels of automation in vehicles, with higher automation levels necessitating advanced braking capabilities. Brake-by-wire systems, integrated with electronic control units, become crucial for precise and responsive braking in autonomous vehicles. With several automotive manufacturers and tech companies investing in autonomous vehicle development, the automotive brake system market has the opportunity to provide cutting-edge solutions that align with the safety and operational requirements of self-driving vehicles. This trend positions brake system manufacturers to play a pivotal role in shaping the future of mobility as autonomous technologies continue to advance.

Brake System Market Challenges

Environmental Concerns and Brake Dust

A substantial challenge facing the automotive brake system market is the environmental impact associated with brake dust. Conventional braking systems generate particulate matter during operation, including harmful metals like copper. The U.S. Environmental Protection Agency (EPA) has identified copper as a water pollutant of concern. As vehicles with traditional braking systems contribute to this pollution, there is a growing call for eco-friendly brake solutions. The challenge lies in developing alternative brake materials or advanced technologies that minimize or eliminate harmful emissions, meeting environmental regulations. Brake system manufacturers face the task of innovating to reduce the environmental footprint of braking systems while maintaining optimal performance.

Material Supply Chain Disruptions

Another notable challenge for the automotive brake system market is the vulnerability to disruptions in the global supply chain for critical materials. Brake systems often incorporate materials like rare earth metals, which are crucial for manufacturing components such as magnets in regenerative braking systems. The automotive industry has faced disruptions due to factors such as geopolitical tensions, trade disputes, and the COVID-19 pandemic. The International Trade Centre (ITC) highlights the interconnected nature of the automotive supply chain. Challenges in securing a stable supply of essential materials can lead to production delays and increased costs for brake system manufacturers. Managing these supply chain risks and exploring alternative materials or sourcing strategies become critical for the automotive brake system market to ensure resilience in the face of geopolitical and global economic uncertainties.

Regional Trends

North America: In North America, the automotive brake system market may be influenced by a strong emphasis on automotive safety and the adoption of advanced driver assistance systems (ADAS). Stricter safety regulations, such as those set by the National Highway Traffic Safety Administration (NHTSA), drive the integration of advanced brake technologies. Additionally, the increasing popularity of electric and hybrid vehicles in the region may lead to a demand for specialized brake systems to cater to the unique requirements of these vehicles.

Europe: Europe has traditionally been at the forefront of automotive safety and environmental regulations. The brake system market trends in Europe are likely shaped by the Euro NCAP safety standards and the European Union’s push for more sustainable transportation. The region may see a growing demand for regenerative braking systems and eco-friendly brake materials to align with environmental goals.

Asia Pacific: The Asia Pacific region, with its significant automotive production and growing consumer markets, could witness trends such as increased adoption of advanced braking technologies. The rapid expansion of the electric vehicle market, particularly in countries like China, may drive innovations in brake systems to meet the specific needs of electric and hybrid vehicles. Additionally, the emphasis on vehicle safety and government initiatives supporting advanced automotive technologies can contribute to market trends in this region.

Middle East and Africa: In the Middle East and Africa, trends in the automotive brake system market may be influenced by economic growth, infrastructure development, and government initiatives promoting road safety. The adoption of safety features and advanced braking technologies could see an uptick as these regions modernize their transportation systems.

Latin America: Latin America’s automotive brake system market trends might be shaped by economic conditions, vehicle production rates, and consumer preferences. As the region experiences shifts in automotive demand, trends could include a focus on cost-effective braking solutions without compromising safety standards.

Key Players

Key players operating in the global automotive brake system market are Continental AG, ZF Friedrichshafen AG, Robert Bosch GmbH, Akebono Brake Industry Co., Ltd., AISIN CORPORATION, Hitachi Astemo Ltd., Brembo S.p.A., Knorr-Bremse AG, Denso Corporation, Haldex AB, Mando Corporation, Hyundai Mobis Co., Ltd., Bethel Automotive Safety System Co., Ltd. (WBTL), Wuhan Youfin Auto Parts Co., Ltd., Beringer, Ebc Brakes, BWI Group, and NIFO S.R.L.

PRICE

ASK FOR FREE SAMPLE REPORT