Global Medical Packaging Films Market, By Type (Thermoformable Film, High Barrier Film, Metallized Film), Material (Polyethylene (PE), Polypropylene (PP), Polyamide (PA), Polyvinyl Chloride (PVC)), Application (Bags, Tubes), and Region – Industry Analysis and Forecast to 2030

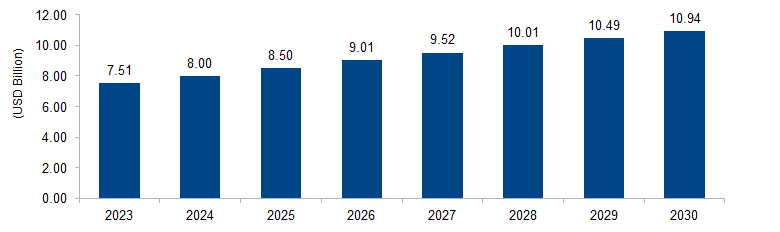

The global medical packaging films market is expected to grow from USD 7.51 billion in 2023 to USD 10.94 billion by 2030 at a CAGR of 5.5%. The market is driven by stringent regulatory requirements, emphasizing the need for sterile and protective packaging for medical devices and pharmaceutical products. The increasing demand for advanced barrier films ensures extended shelf life and contamination prevention, fostering growth in the medical packaging films sector.

Figure 1: Global Medical Packaging Films Market Size, 2023-2030 (USD Billion)

Source: Secondary Research, Expert Interviews, and MAARECO Analysis

Medical Packaging Films refer to specialized materials used in the production of packaging for medical devices and pharmaceutical products. These films are designed to meet strict regulatory standards and ensure the integrity, safety, and sterility of medical and healthcare products. The films offer essential properties such as barrier protection against moisture, gases, and contaminants, maintaining the efficacy and shelf life of the packaged items. Medical packaging films may include materials like polyethylene, polypropylene, polyester, and laminates, tailored to provide the necessary protective and barrier characteristics required in the healthcare industry, contributing to the preservation and safety of medical products during storage and transportation.

Medical Packaging Films Market Drivers

Stringent Regulatory Requirements and Quality Standards

A key driver for the medical packaging films market is the stringent regulatory landscape and the emphasis on maintaining high-quality standards in the healthcare industry. Regulatory authorities, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), impose strict guidelines on the packaging of medical devices and pharmaceuticals to ensure product safety and efficacy. Compliance with these regulations necessitates the use of advanced and specialized medical packaging films that provide superior barrier properties, prevent contamination, and maintain the sterility of the enclosed products. For instance, the FDA’s regulations for packaging materials in direct contact with pharmaceuticals require materials that do not adversely affect the product’s safety, identity, strength, quality, or purity.

The demand for medical packaging films is driven by the need for materials that meet these rigorous regulatory standards. As healthcare industries globally strive to adhere to evolving regulations, the market for medical packaging films continues to grow. The stringent quality and safety requirements underscore the critical role of these films in ensuring the integrity of medical products, contributing to the overall growth and expansion of the medical packaging films sector.

Rising Healthcare Expenditure and Increasing Medical Device Usage

The increasing global healthcare expenditure and the growing usage of medical devices contribute significantly to the growth of the medical packaging films market. As healthcare infrastructure expands, particularly in emerging economies, there is a parallel rise in the demand for medical devices and pharmaceuticals. The World Health Organization (WHO) indicates a global increase in healthcare spending, driven by factors such as population growth, aging demographics, and advancements in medical technologies. This surge in healthcare investments propels the production and consumption of medical packaging films used to safeguard these healthcare products.

Additionally, the escalating prevalence of chronic diseases and the subsequent demand for innovative medical treatments drive the adoption of medical devices, further fueling the need for advanced packaging solutions. As per the European Medical Device Market Statistics 2020, the European medical devices market witnessed robust growth, contributing to the increased demand for specialized packaging materials. The medical packaging films market, aligned with the growth in healthcare spending and medical device utilization, plays a pivotal role in ensuring the protection and integrity of medical products, driving its expansion in response to the evolving landscape of global healthcare.

Medical Packaging Films Market Restraints

Cost Constraints and Budgetary Pressures

A significant restraint for the medical packaging films market stems from cost constraints and budgetary pressures within the healthcare industry. The strict economic considerations faced by healthcare providers and manufacturers necessitate a balance between the need for high-quality packaging and the associated costs. The procurement of specialized medical packaging films, which adhere to stringent regulatory standards and offer advanced barrier properties, often incurs higher production expenses. According to the World Health Organization (WHO), many countries face challenges related to constrained healthcare budgets, limiting their ability to allocate substantial funds for packaging materials.

The cost-conscious nature of the healthcare sector can impede the widespread adoption of advanced and expensive medical packaging films, especially in regions with limited financial resources. Healthcare organizations and manufacturers may face difficulties in justifying the additional costs of premium packaging materials, affecting the market’s growth potential. The challenge lies in developing cost-effective solutions without compromising on the critical requirements of safety, sterility, and regulatory compliance, presenting a restraint for the medical packaging films market as it navigates the delicate balance between quality and affordability.

Environmental Concerns and Sustainability Challenges

Another restraint for the medical packaging films market is the increasing focus on environmental concerns and the challenges associated with sustainability. The healthcare industry is under growing pressure to reduce its environmental footprint and minimize the use of non-recyclable materials. Medical packaging films, often made from complex multilayer structures to meet stringent requirements, may pose challenges for recycling and environmental impact. Government agencies and regulatory bodies, recognizing the ecological consequences of packaging waste, are increasingly advocating for sustainable alternatives.

The healthcare sector’s transition towards environmentally friendly practices, coupled with regulatory initiatives promoting the circular economy, poses challenges for traditional medical packaging films. For instance, the European Parliament’s Single-Use Plastics Directive targets the reduction of certain single-use plastics, impacting the medical packaging landscape. Developing sustainable alternatives without compromising on the essential characteristics of medical packaging films is a significant challenge, hindering the market’s growth as it navigates the complex intersection of healthcare needs and environmental responsibility.

Medical Packaging Films Market Opportunities

Advanced Materials and Technology Integration

An exciting opportunity for the medical packaging films market lies in the integration of advanced materials and technology. The ongoing advancements in materials science and packaging technologies offer opportunities for creating innovative and high-performance medical packaging films. For instance, the development of nanocomposite films with enhanced barrier properties can significantly contribute to the market’s growth. According to the National Center for Biotechnology Information (NCBI), nanotechnology-based materials are being explored for their potential applications in medical packaging, providing superior barrier properties against gases and microbes.

Furthermore, the integration of smart packaging technologies, such as RFID and sensor-based systems, presents a promising avenue for medical packaging films. Smart packaging can enable real-time monitoring of the condition and integrity of medical products, enhancing supply chain visibility and ensuring product quality. The global smart packaging market is projected to reach significant values, opening up opportunities for the medical packaging films sector to capitalize on the demand for technologically advanced solutions.

Rise in Biopharmaceuticals and Personalized Medicine

The growing prominence of biopharmaceuticals and personalized medicine presents a substantial opportunity for the medical packaging films market. The shift towards precision medicine and the increasing development of biologically derived drugs necessitate specialized packaging solutions. According to the Journal of Personalized Medicine, the global market for personalized medicine is expanding, driven by advancements in genomics and the demand for targeted therapies. Medical packaging films designed to meet the unique requirements of biopharmaceuticals, including protection from light, oxygen, and moisture, are in high demand.

Personalized medicine often involves smaller production batches and customized dosages, requiring flexible and adaptable packaging solutions. The use of advanced films that offer compatibility with biopharmaceutical formulations, maintain product stability, and ensure precise dosing aligns with the evolving landscape of personalized medicine. The medical packaging films market can capitalize on this opportunity by catering to the specific needs of biopharmaceutical packaging, contributing to the sector’s growth as it aligns with the trajectory of personalized and precision medicine.

Medical Packaging Films Market Challenges

Global Supply Chain Disruptions and Material Shortages

A significant challenge facing the medical packaging films market is the vulnerability to global supply chain disruptions and shortages of critical materials. The COVID-19 pandemic highlighted the fragility of supply chains, affecting the availability and pricing of raw materials essential for medical packaging films. According to the World Trade Organization (WTO), the pandemic led to a decline in global merchandise trade, impacting the supply chain for various industries, including healthcare. Disruptions in logistics, transportation, and production resulted in delays and shortages of materials for medical packaging films.

Moreover, the industry relies on specialized polymers and additives that may face shortages due to geopolitical tensions, natural disasters, or economic fluctuations. Ensuring a stable supply chain becomes a critical challenge for manufacturers in the medical packaging films market. Developing strategies for diversification of suppliers, strategic stockpiling, and efficient risk management are imperative to mitigate the impact of global disruptions, safeguarding the continuous production of medical packaging films and meeting the healthcare sector’s needs.

Rapid Technological Changes and Adoption Challenges

The rapid pace of technological changes poses a unique challenge for the medical packaging films market. While technological advancements offer opportunities, the swift evolution of materials science and packaging technologies introduces challenges related to the adoption of new and innovative solutions. For example, the development of biodegradable or recyclable medical packaging films aligns with sustainability goals, but the adoption of such materials faces hurdles due to the need for rigorous testing and validation in the healthcare sector.

Additionally, integrating smart packaging technologies into medical films, such as sensor-based monitoring or RFID systems, requires seamless compatibility with existing healthcare practices and regulatory standards. The conservative nature of the healthcare industry and the stringent regulatory requirements make the adoption of novel technologies a gradual and complex process. Balancing innovation with the need for proven safety and efficacy becomes a challenge for the medical packaging films market. Overcoming the inertia of established practices and gaining widespread acceptance for new technologies within the healthcare supply chain necessitates collaboration, education, and meticulous validation processes, posing a distinct challenge for market players.

Regional Trends

North America: In North America, there has been a notable trend towards sustainable and eco-friendly medical packaging films. Regulatory bodies, including the U.S. FDA, have been emphasizing the importance of environmentally responsible packaging in the healthcare sector. The region has seen an increased adoption of biodegradable and recyclable materials for medical packaging films. Additionally, advancements in smart packaging technologies have gained traction, enhancing traceability and ensuring product integrity.

Europe: Europe has witnessed a dual focus on sustainability and compliance with stringent regulatory standards. The European Medicines Agency (EMA) and other regulatory bodies have been driving the adoption of environmentally friendly packaging materials in the healthcare sector. The Circular Economy Package and the European Green Deal have influenced the push for recyclable and biodegradable medical packaging films. Moreover, there has been a trend towards integrating technologies like RFID and smart sensors for improved monitoring and traceability.

Asia Pacific: In the Asia Pacific region, the medical packaging films market has seen dynamic growth, aligned with the expanding healthcare infrastructure. The demand for cost-effective and innovative packaging solutions, including flexible medical packaging films, has been on the rise. The region has also witnessed increased investments in research and development to create materials that meet both regulatory requirements and cost considerations. Additionally, the adoption of advanced manufacturing technologies has contributed to the production of high-quality medical packaging films in the Asia Pacific.

Middle East and Africa: The Middle East and Africa have experienced a surge in demand for medical packaging films due to expanding healthcare access and the rising prevalence of chronic diseases. The region has shown interest in advanced packaging technologies to ensure product safety and quality. The Middle East, in particular, has seen an increased focus on high-performance packaging materials to meet the specific needs of the healthcare sector.

Latin America: Latin America has demonstrated a trend towards modernization in the healthcare sector, influencing the adoption of advanced medical packaging films. The region has been exploring solutions that balance cost-effectiveness with regulatory compliance. Initiatives to improve healthcare infrastructure and enhance pharmaceutical packaging standards have contributed to the evolving trends in medical packaging films in Latin America.

Key Players

Key players operating in the global medical packaging films market are Amcor plc, Berry Global Inc., DuPont de Nemours, Inc., Renolit SE, Sealed Air Corporation, Weigao Group, Covestro AG, 3M, Toppan Inc., Mitsubishi Chemical Corporation, Wipak, Toray Industries, Inc., Dunmore, TekniPlex, Aptargroup, Inc., Eagle Flexible Packaging, Printpack, and UFP Technologies.

PRICE

ASK FOR FREE SAMPLE REPORT