Global Hexamethylenediamine Market, By End Use (Nylon Synthesis, Lubricants, Adhesives, Curing Agents, Intermediate for Coatings, Biocides, Water Treatment Chemicals), Industry Vertical (Textile, Automotive, Paints & Coatings, Petrochemicals), and Region – Industry Analysis and Forecast to 2030

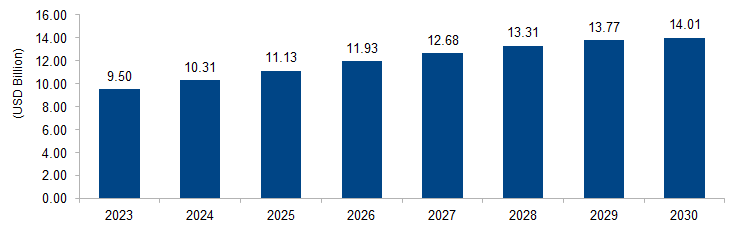

The global Hexamethylenediamine market is expected to grow from USD 9.50 billion in 2023 to USD 14.01 billion by 2030 at a CAGR of 5.7%. The market is driven by factors such as polymer production, automotive industry, textile industry, adhesives and coatings, consumer goods, increasing urbanization, global industrialization, research and development, shift towards sustainable polymers, and emerging markets. These drivers collectively contribute to the demand for Hexamethylenediamine and its derivatives across various industries. As industries evolve and consumer preferences change, the market for Hexamethylenediamine continues to adapt and expand to meet these demands.

Figure 1: Global Hexamethylenediamine Market Size, 2023-2030 (USD Billion)

Source: Secondary Research, Expert Interviews, and MAARECO Analysis

Hexamethylenediamine is an organic compound with the chemical formula C6H16N2. It is a diamine, meaning it contains two amino groups (-NH2) separated by a six-carbon chain. Hexamethylenediamine is a clear and colorless liquid with a slightly amine-like odor. It is primarily used as a chemical building block in the production of various polymers and high-performance materials.

Hexamethylenediamine plays a crucial role in the synthesis of nylon 66 (polyamide 66), a versatile and widely used polymer. Nylon 66 is known for its exceptional strength, durability, and resistance to abrasion. It finds applications in industries such as textiles, automotive manufacturing, engineering plastics, consumer goods, and more.

Due to its ability to form strong hydrogen bonds and its long carbon chain, Hexamethylenediamine is a valuable intermediate in the creation of polymers that exhibit these desirable properties. Its applications extend beyond the realm of polymers, with uses in adhesives, coatings, and other chemical processes where its unique chemical structure can contribute to the development of high-performance materials.

Hexamethylenediamine Market Drivers

Polymer Production

The driver of polymer production is a key factor propelling the demand for Hexamethylenediamine in the market. Hexamethylenediamine plays a pivotal role as a crucial building block in the production of polymers, particularly nylon 66 (polyamide 66). Nylon 66 is a high-performance synthetic polymer known for its exceptional strength, durability, and versatility. It finds widespread application in numerous industries, including textiles, automotive manufacturing, engineering plastics, consumer goods, and more.

In polymer production, Hexamethylenediamine serves as a critical monomer that forms the foundational structure of nylon 66. The diamine nature of Hexamethylenediamine, with its two amino groups separated by a six-carbon chain, enables the formation of strong hydrogen bonds within the polymer’s molecular structure. This results in a material with remarkable mechanical properties, making nylon 66 ideal for applications requiring high strength, resilience, and resistance to wear and tear.

Industries such as automotive manufacturing utilize nylon 66 for various components, including engine parts, electrical connectors, and interior components, thanks to its ability to withstand challenging conditions. In textiles, nylon 66’s durability and lightweight nature make it a popular choice for sportswear, activewear, and other performance-oriented fabrics. Additionally, nylon 66 is used in the production of consumer goods like luggage, footwear, and household appliances, further contributing to the demand for Hexamethylenediamine.

As industrialization and technological advancements continue to drive the demand for high-performance materials, polymer production remains a significant driver for the Hexamethylenediamine market. The versatility and wide range of applications of nylon 66, coupled with the inherent strength provided by Hexamethylenediamine, make it a fundamental component in industries seeking materials that can meet stringent performance requirements and contribute to the development of innovative and durable products.

Adhesives and Coatings

The driver of adhesives and coatings applications is a significant factor contributing to the demand for Hexamethylenediamine in the market. Hexamethylenediamine’s unique chemical properties make it a valuable component in the formulation of adhesives and coatings with enhanced performance characteristics. Adhesives and coatings play a vital role in industries such as construction, electronics, packaging, automotive, and more.

Hexamethylenediamine’s ability to form strong hydrogen bonds and its long carbon chain make it a suitable building block for creating high-performance adhesives. When incorporated into adhesive formulations, Hexamethylenediamine contributes to improved bonding strength, adhesion to various substrates, and resistance to environmental stresses. These properties are essential in applications where adhesives need to withstand a wide range of conditions, such as fluctuating temperatures, moisture, and mechanical stresses.

In the coatings industry, Hexamethylenediamine’s characteristics contribute to the creation of durable and protective coatings. Coatings formulated with Hexamethylenediamine can exhibit excellent adhesion to surfaces, corrosion resistance, and the ability to form a robust barrier against environmental factors like moisture, chemicals, and UV radiation. These qualities are highly desirable in industries that require protective coatings for products, equipment, and infrastructure.

Industries like construction benefit from Hexamethylenediamine-based adhesives and coatings for bonding materials, such as concrete and metals, while electronics rely on these formulations for adhering components and protecting sensitive electronic devices. The automotive sector also utilizes Hexamethylenediamine-containing coatings for corrosion prevention and improved surface durability.

As industries seek advanced materials to enhance the performance and longevity of products, the demand for high-quality adhesives and coatings continues to rise. This driver underscores Hexamethylenediamine’s importance as a versatile component that contributes to the formulation of adhesives and coatings capable of meeting the stringent requirements of various applications across different sectors.

Hexamethylenediamine Market Restraints

Raw Material Availability

The restraint of raw material availability is a critical factor that can impact the Hexamethylenediamine market. Hexamethylenediamine is primarily synthesized from petrochemical feedstocks, with adiponitrile being a key precursor. Adiponitrile, in turn, is derived from butadiene, a compound obtained from the cracking of hydrocarbons. The availability and price of these raw materials, especially crude oil and butadiene, can significantly influence the cost and supply of Hexamethylenediamine.

Global crude oil prices and petrochemical feedstock availability are subject to market fluctuations influenced by geopolitical events, supply-demand imbalances, and economic conditions. These variations can lead to uncertain supply chains and cost volatility for Hexamethylenediamine manufacturers and their customers. Sudden disruptions in crude oil supply, such as those caused by geopolitical tensions or natural disasters, can impact the availability of the raw materials needed for Hexamethylenediamine production.

Furthermore, the competition for these petrochemical feedstocks between various industries adds complexity to the raw material availability challenge. Fluctuations in the demand from other sectors, such as plastics, chemicals, and energy, can create supply constraints for the Hexamethylenediamine market, affecting its price and stability.

To mitigate the impact of raw material availability constraints, Hexamethylenediamine manufacturers may explore diversification of feedstock sources, invest in advanced production technologies, and consider alternative feedstock options. Additionally, sustainable and bio-based routes to produce Hexamethylenediamine could alleviate dependence on fossil fuel-derived feedstocks, helping address both raw material availability concerns and sustainability demands.

Navigating the raw material availability restraint requires a proactive approach involving close monitoring of global market trends, strategic partnerships with suppliers, and investments in research and development to explore alternative sourcing methods. By doing so, manufacturers can better manage supply chain risks and ensure a consistent and reliable supply of Hexamethylenediamine for downstream applications.

Environmental Regulations

The restraint posed by environmental regulations is a significant factor influencing the Hexamethylenediamine market. As industries face increasing pressure to reduce their environmental impact, stringent regulations governing chemical manufacturing, waste disposal, and emissions control have emerged. Hexamethylenediamine production and its derivatives are subject to these regulations, which can add complexities and costs to the manufacturing process.

Environmental regulations encompass various aspects, including air and water quality standards, hazardous waste disposal, emissions control, and worker safety. Hexamethylenediamine production involves several chemical reactions that may release byproducts or waste streams, necessitating compliance with disposal regulations to prevent pollution and contamination of ecosystems. Additionally, emissions resulting from Hexamethylenediamine manufacturing processes could contribute to air pollution if not properly managed.

Meeting these regulations often requires investments in pollution control technologies, waste management infrastructure, and safety measures to ensure the well-being of workers and communities surrounding production facilities. Compliance with these regulations can increase operational costs, impacting the overall competitiveness and profitability of Hexamethylenediamine manufacturers.

Moreover, environmental regulations are subject to change as governments and international bodies continue to prioritize sustainability and safety. Manufacturers must stay vigilant to remain compliant with evolving standards, which may necessitate adjustments to processes, equipment, and even the development of new formulations.

To address the restraint of environmental regulations, Hexamethylenediamine manufacturers can focus on sustainable production practices, waste reduction strategies, and the development of eco-friendly manufacturing processes. Investing in research and innovation to create more environmentally friendly products can align with both regulatory demands and consumer preferences. Collaborating with regulatory authorities, industry associations, and research institutions can help manufacturers navigate the complex landscape of environmental regulations while contributing to a more sustainable and responsible Hexamethylenediamine market.

Hexamethylenediamine Market Opportunities

Growing Automotive Sector

The opportunity presented by the growing automotive sector holds significant potential for the Hexamethylenediamine market. The automotive industry’s ongoing quest for innovation and performance improvement has led to an increasing demand for advanced materials that can meet stringent requirements for strength, durability, and lightweight properties. Hexamethylenediamine-derived products, particularly nylon 66 polymers, are well-positioned to address these demands and play a vital role in shaping the future of automotive manufacturing.

In the automotive sector, lightweighting has become a paramount goal to enhance fuel efficiency, reduce emissions, and improve overall vehicle performance. Hexamethylenediamine-based nylon 66 polymers offer a combination of high tensile strength, thermal stability, and low weight – characteristics that make them ideal candidates for various automotive components. These components range from engine parts and structural elements to interior components and electrical connectors.

Hexamethylenediamine-based polymers contribute to improved fuel efficiency by reducing the overall weight of vehicles without compromising on safety or durability. Additionally, their resistance to heat and chemicals makes them suitable for applications in engine compartments and under-the-hood components that are exposed to challenging operating conditions.

As the automotive sector embraces electric and hybrid vehicles, the need for lightweight materials that can enhance battery efficiency and extend vehicle range becomes even more critical. Hexamethylenediamine-derived materials can find applications in battery components, connectors, and housings, contributing to the advancement of electric vehicle technology.

Moreover, the growing demand for luxury and comfort features in vehicles has led to increased adoption of Hexamethylenediamine-based polymers in interior components. These materials offer design flexibility, excellent surface finish, and resistance to wear and tear, enhancing the overall aesthetics and durability of automotive interiors.

In summary, the opportunity presented by the growing automotive sector highlights the role that Hexamethylenediamine-based materials, particularly nylon 66 polymers, can play in shaping the future of vehicle manufacturing. By addressing the industry’s need for lightweight, durable, and high-performance materials, Hexamethylenediamine manufacturers can position themselves as valuable partners in driving innovation and advancement within the automotive industry.

Research and Development

The opportunity in research and development (R&D) holds immense potential for the Hexamethylenediamine market. In an era of rapid technological advancements and evolving industry demands, investing in R&D activities surrounding Hexamethylenediamine-based products can lead to innovation, product diversification, and the exploration of new applications. Through R&D, manufacturers can fine-tune existing processes, create novel formulations, and unlock new properties that cater to the needs of various industries.

Investigating novel uses for Hexamethylenediamine-derived materials can drive product diversification. By leveraging the unique characteristics of Hexamethylenediamine-based polymers, researchers can develop tailor-made solutions for specific applications. This can lead to the creation of specialty products that cater to niche markets or emerging industries, expanding the potential customer base and revenue streams.

Collaboration between Hexamethylenediamine manufacturers, research institutions, and downstream industries can accelerate the pace of innovation. Open collaboration can foster a fertile ground for sharing insights, expertise, and resources, ultimately leading to breakthroughs that address industry challenges and drive market growth.

As environmental concerns and sustainability goals gain prominence, R&D can also explore the development of bio-based alternatives to Hexamethylenediamine. Investigating sustainable sourcing methods and eco-friendly manufacturing processes can align with market demands and regulatory expectations, opening avenues for Hexamethylenediamine products with reduced environmental impact.

In essence, the opportunity in research and development for the Hexamethylenediamine market is a catalyst for evolution and growth. By investing in R&D initiatives, manufacturers can stay ahead of industry trends, anticipate customer needs, and position themselves as leaders in innovation. The outcomes of these efforts not only drive product advancements but also contribute to the overall sustainability and competitiveness of the Hexamethylenediamine market on a global scale.

Hexamethylenediamine Market Challenges

Competition from Alternatives

The challenge posed by competition from alternatives is a significant factor influencing the Hexamethylenediamine market. As industries strive for enhanced sustainability, performance, and cost-effectiveness, alternative materials and solutions to traditional Hexamethylenediamine-based products are emerging. These alternatives can include bio-based polymers, other specialty chemicals, and innovative materials that offer comparable or superior properties for specific applications.

The rise of bio-based alternatives is particularly noteworthy. As concerns about environmental impact grow, industries are exploring materials derived from renewable sources that have a reduced carbon footprint. Bio-based polymers and chemicals can offer similar functionalities to Hexamethylenediamine-based products while addressing the demand for eco-friendly solutions. Manufacturers that adopt these alternatives can meet consumer preferences for sustainability and gain a competitive edge in a market that prioritizes environmental consciousness.

To address the challenge of competition from alternatives, Hexamethylenediamine manufacturers must stay attuned to market trends and proactively innovate. This might involve investing in research and development to enhance the performance and sustainability of Hexamethylenediamine-based products. Collaborating with downstream industries and customers to understand their evolving needs can guide the development of tailored solutions that retain Hexamethylenediamine’s competitive edge.

Additionally, positioning Hexamethylenediamine as a versatile component in the creation of hybrid materials that combine the advantages of different materials can differentiate it from alternatives. Manufacturers should focus on highlighting the unique properties of Hexamethylenediamine and demonstrating its value proposition in terms of performance, cost-effectiveness, and sustainability.

Shifts in Consumer Demand

The challenge posed by shifts in consumer demand is a crucial factor influencing the Hexamethylenediamine market. As consumer preferences evolve, driven by factors such as sustainability, safety, and performance, industries that rely on Hexamethylenediamine-based products must adapt to these changing expectations. Consumer demand for products that align with environmental consciousness and health considerations has the potential to significantly impact the market dynamics of Hexamethylenediamine-derived materials.

As sustainability becomes a prominent consideration, consumers are seeking products that have a reduced environmental footprint. This trend is prompting industries to explore alternatives to traditional materials, including Hexamethylenediamine-derived polymers, that may have environmental impacts during production, use, or disposal. This shift in consumer demand can lead to a decrease in the utilization of Hexamethylenediamine-based products if they are not perceived as environmentally friendly.

Moreover, changing consumer preferences for products that prioritize safety, particularly in industries such as food packaging or medical devices, can drive demand for materials with higher standards of purity and non-toxicity. Industries must ensure that Hexamethylenediamine-based materials meet these stringent safety criteria to retain consumer trust and compliance with regulatory requirements.

To address the challenge of shifts in consumer demand, manufacturers of Hexamethylenediamine-based products should proactively communicate the benefits and attributes of their materials. Highlighting the performance advantages, safety standards, and efforts toward sustainability can help educate consumers and industry stakeholders about the value proposition of Hexamethylenediamine-derived materials.

Regional Trends

Asia-Pacific: The Asia-Pacific region, led by countries like China, India, and South Korea, has shown robust growth in industries that utilize Hexamethylenediamine-based products. Rapid urbanization, industrial expansion, and a thriving automotive sector in these countries have contributed to increased demand for polymers, textiles, coatings, and adhesives, all of which can drive the Hexamethylenediamine market.

North America and Europe: These regions have well-established manufacturing sectors that include automotive, aerospace, textiles, and specialty chemicals. The demand for advanced materials and technological innovation in these sectors can drive the usage of Hexamethylenediamine-based products. Additionally, growing emphasis on sustainability and regulatory compliance has encouraged the adoption of eco-friendly materials, potentially benefiting the Hexamethylenediamine market.

Key Players

Key players operating in the global Hexamethylenediamine market are BASF SE, Toray Industries, Inc., Dupont De Nemours, Inc., Asahi Kasei Corporation, Merck KGaA, Evonik, Ashland, Lanxess, Invista, Ascend Performance Materials, Junsei Chemical Co.,Ltd., Daejung Chemicals & Metals Co.,Ltd., Suzhou Sibian Chemicals Co., Ltd., Genomatica, Italmatch Chemicals, and Alfa Aesar.

PRICE

ASK FOR FREE SAMPLE REPORT